Will the interest rate cut be confirmed next week? Nasdaq breaks 20,000 points for the first time, Bitcoin reaches $100,000

Original title: "Is the interest rate cut "stable" next week? Nasdaq breaks 20,000 points for the first time, and Bitcoin stands at $101,000"

Original source: BitpushNews

After the release of the US Consumer Price Index (CPI) data for November, US stocks and crypto markets rose.

The US CPI data for November rose 2.7% year-on-year, higher than 2.6% in October, in line with market expectations. The monthly rate of CPI in November rose 0.3%, slightly higher than 0.2% in the previous month. Among them, the core CPI rose 3.3%, the same as in October.

FedWatch Tool data shows that the probability of the Federal Reserve cutting interest rates by 25 basis points next week has risen to more than 96%.

As of the close of U.S. stocks on Wednesday, the Dow Jones Industrial Average initially closed down 0.2%, the S&P 500 rose 0.8%, and the Nasdaq rose 1.77%, breaking the 20,000 mark for the first time. Tesla (TSLA.O) and Google (GOOG.O) both rose more than 5.5% and set new highs.

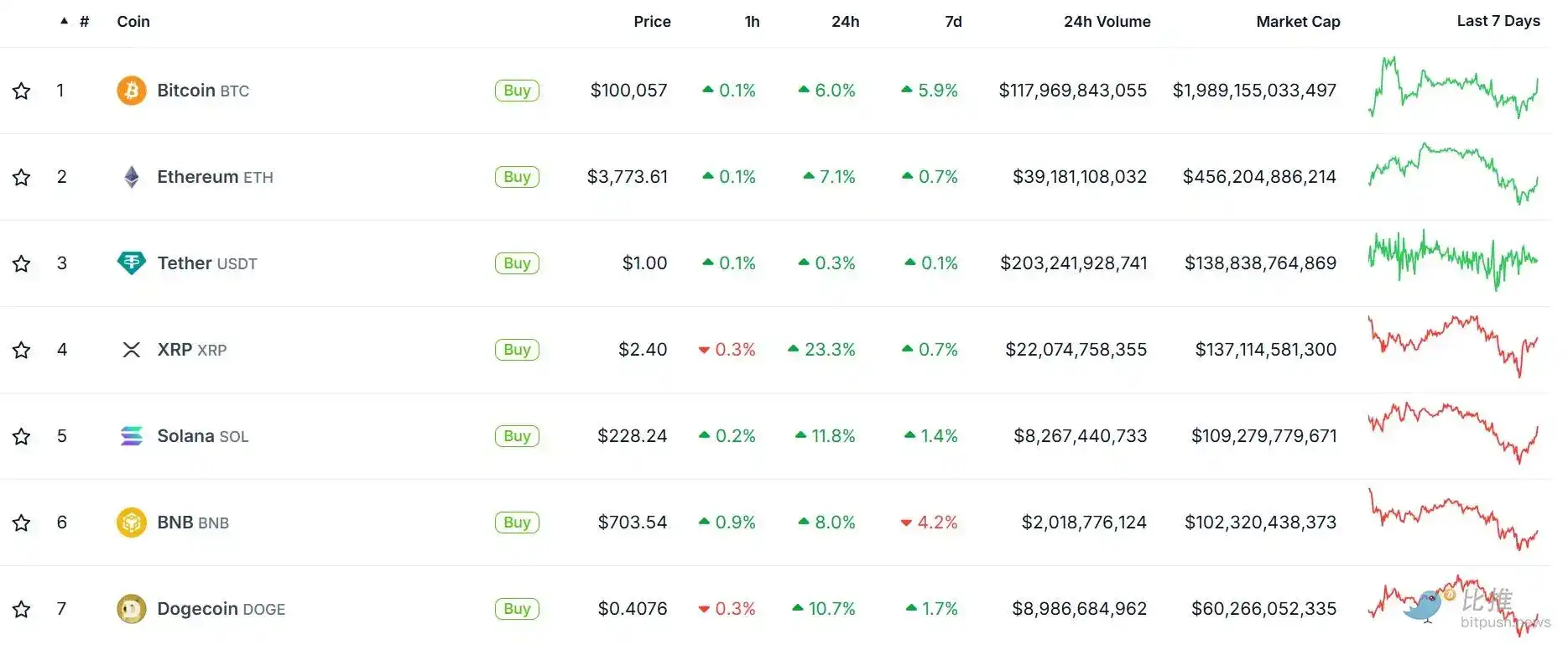

In the crypto market, Bitcoin rebounded to more than $101,000, up more than 6% in the past 24 hours, while XRP, Solana (SOL) and Cardano (ADA) rose 23%, 11% and 16% respectively during the same period.

Dogecoin (DOGE), Shiba Inu (SHIB), dogwifhat (WIF), BONK and FLOKI and other meme coins have achieved double-digit gains. AI concept tokens also rose by more than 7%, with NEAR, ICP and Render up more than 10%.

Institutional Buying on Dips

Data from Sosovalue shows that institutional investors are seizing the opportunity to buy on dips, with $439.5 million flowing into U.S. spot Bitcoin ETFs on December 10. The U.S. spot Ethereum ETF recorded the third-largest daily inflow ever at $305.7 million. Arkham monitoring data shows that BlackRock and Fidelity ETFs have purchased more than $500 million worth of ETH in the past 48 hours.

Trader: BTC's next target is around $112,000

Skew, a well-known trader, pointed out that the market is currently in a state of supply and demand balance, and emphasized that there are "passive buyers" supporting prices. In addition, he also mentioned that there are strong buying and selling orders around $97,000 on Binance, the world's largest cryptocurrency exchange.

Another trader, Roman, analyzed from the perspective of the daily chart that the relative strength index (RSI) has been completely reset, which indicates that Bitcoin may usher in a strong wave of gains, with a target price of around $112,000.

Well-known trader Johnny also said that Bitcoin has rebounded several times around $95,000, showing strong support and is expected to continue to rise in the future.

Chart analyst Upadhyay believes that the strong rebound of Bitcoin prices from the 20-day moving average (about $96,133) shows that the bulls are still strong. If the resistance range of $101,351 to $104,088 can be effectively broken, the upward trend will be further confirmed. At that time, Bitcoin is expected to hit $113,331 and even challenge the $125,000 mark.

However, if the price falls below the 20-day moving average, it may trigger profit-taking selling, causing the price to fall back to around $90,000. Therefore, $90,000 is the focus of competition between bulls and bears, and it is also an important support level.

On the whole, many analysts are optimistic about the future trend of Bitcoin. Although the market may fluctuate to a certain extent in the short term, the overall trend is still biased towards bulls.

You may also like

Who's at the CFTC Table? A Rebalancing of American Fintech Discourse

AI Trading vs Human Crypto Traders: $10,000 Live Trading Battle Results in Munich, Germany (WEEX Hackathon 2026)

Discover how AI trading outperformed human traders in WEEX's live Munich showdown. Learn 3 key strategies from the battle and why AI is changing crypto trading.

Elon Musk's X Money vs. Crypto's Synthetic Dollars: Who Wins the Future of Money?

How do Synthetic Dollars work? This guide explains their strategies, benefits over traditional stablecoins like USDT, and risks every crypto trader must know.

The Israeli military is hunting a mole on Polymarket

Q4 $667M Net Loss: Coinbase Earnings Report Foreshadows Challenging 2026 for Crypto Industry?

BlackRock Buying UNI, What's the Catch?

Lost in Hong Kong

Gold Plunges Over 4%, Silver Crashes 11%, Stock Market Plummet Triggers Precious Metals Algorithmic Selling Pressure?

Coinbase and Solana make successive moves, Agent economy to become the next big narrative

Aave DAO Wins, But the Game Is Not Over

Coinbase Earnings Call, Latest Developments in Aave Tokenomics Debate, What's Trending in the Global Crypto Community Today?

ICE, the parent company of the NYSE, Goes All In: Index Futures Contracts and Sentiment Prediction Market Tool

On-Chain Options: The Crossroads of DeFi Miners and Traders

How WEEX and LALIGA Redefine Elite Performance

WEEX x LALIGA partnership: Where trading discipline meets football excellence. Discover how WEEX, official regional partner in Hong Kong & Taiwan, brings crypto and sports fans together through shared values of strategy, control, and long-term performance.

Best Crypto to Buy Now February 10 – XRP, Solana, Dogecoin

Key Takeaways XRP is set to revolutionize cross-border transactions, potentially reaching $5 by the end of Q2 with…

Kyle Samani Criticizes Hyperliquid in Explosive Post-Departure Market Commentary

Key Takeaways: Kyle Samani, former co-founder of Multicoin Capital, publicly criticizes Hyperliquid, labeling it a systemic risk. Samani’s…

Leading AI Claude Forecasts the Price of XRP, Cardano, and Ethereum by the End of 2026

Key Takeaways: XRP’s value is projected to reach $8 by 2026 due to major institutional adoption. Cardano (ADA)…

Bitcoin Price Prediction: Alarming New Research Cautions Millions in BTC at Risk of ‘Quantum Freeze’ – Are You Ready?

Key Takeaways Quantum Threat to Bitcoin: The rise of quantum computing presents a unique security challenge to Bitcoin,…

Who's at the CFTC Table? A Rebalancing of American Fintech Discourse

AI Trading vs Human Crypto Traders: $10,000 Live Trading Battle Results in Munich, Germany (WEEX Hackathon 2026)

Discover how AI trading outperformed human traders in WEEX's live Munich showdown. Learn 3 key strategies from the battle and why AI is changing crypto trading.

Elon Musk's X Money vs. Crypto's Synthetic Dollars: Who Wins the Future of Money?

How do Synthetic Dollars work? This guide explains their strategies, benefits over traditional stablecoins like USDT, and risks every crypto trader must know.